- Write by:

-

Thursday, November 2, 2023 - 22:55:22

-

184 Visit

-

Print

Mining News Pro - Copper prices are expected to mount a modest recovery next year as burgeoning demand from the energy transition offsets global economic weakness and healthy mine supply, a Reuters poll showed.

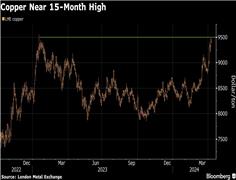

Copper prices have shed about 15% since touching the highest in more seven months in January, pressured by weak economic growth in China, fears of recession elsewhere and high interest rates.

“We see copper grinding higher over the course of 2024 as the two opposing structural trends persist – the struggles of China’s property market on the one side and the energy transition on the other,” said Carsten Menke at Julius Baer in Zurich.

The cash copper contract on the London Metal Exchange (LME) is expected to average $8,625 per metric ton in 2024, a median forecast of 28 analysts showed.

That is 3% weaker than the forecast in the previous quarterly poll, but 7% firmer than Tuesday’s closing price of $8,029.

Analysts forecast a surplus of the metal used in power and construction this year of 112,000 metric tons, with oversupply rising to 302,500 tons next year, up 61% from the previous poll in July.

Analysts move aluminum into surplus

Global aluminum production has ramped up this year as smelters come back on line in Europe as power prices level off and in China’s Yunnan province after hydro power curbs were relaxed.

Together with lacklustre demand due to weak economic activity, especially in Europe, analysts have reversed their expectations of market deficits this year and next for the metal used in packaging, transport and construction.

Analysts now forecast market surpluses of 338,000 tons this year and 250,000 tons in 2024, an about-face from deficits 191,750 tons and 66,000 tons respectively in the July poll.

“Weak consumption within traditional demand sectors will limit gains for aluminum, despite robust green demand, while plentiful supply, particularly on the back of idled capacity coming back online in Europe, will limit aluminum’s upside,” said Natalie Scott-Gray at StoneX in London.

LME cash aluminum is expected to average $2,350 a ton in 2024, up 5% from the current price.

Weak zinc recovery

Zinc has been one of the worst performing LME metals this year, slumping 18% so far in 2023, as weak construction activity has hit the metal’s main use in galvanizing steel.

“We expect some recovery in the price of zinc next year given that global activity will start to pick up in developed economies and should boost demand for zinc-intensive durable goods,” said Caroline Bain at Capital Economics.

Analysts expect LME cash zinc prices to average $2,506 a ton next year, up 4% from current levels.

They expect the global zinc market to show a surplus of 148,000 metric tons this year and 238,000 tons in 2024.

Short Link:

https://www.miningnews.ir/En/News/627603

A key measure of Chinese copper demand just sank to zero, another indication that global prices are not balanced with ...

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer ...

Interros, Nornickel’s largest shareholder, on Monday called allegations by fellow shareholder Rusal about undervalued ...

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Polish government is abandoning plans to separate coal-fired power plants into a special company and is considering ...

French mining group Eramet said on Wednesday it had reached an agreement with the French government to continue its ...

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

No comments have been posted yet ...