- Write by:

-

Monday, January 10, 2022 - 13:21:00

-

397 Visit

-

Print

Mining News Pro - Nickel price rose on Monday to their highest level in more than one month, with inventories of the metal hovering close to record lows.

The most actively traded February nickel contract on the Shanghai Futures Exchange ended daytime trading up 2.5% at 154,840 yuan ($24,300.06) a tonne. Earlier in the session, prices rose to 155,160 yuan, a peak since Nov. 25.

Three-month nickel on the London Metal Exchange was up 0.9% at $20,915 a tonne, as of 0305 GMT, a jump of more than 15% since last January.

“Nickel prices are expected to remain strong in the short-term amid low inventories and destocking expectations, but increasing capacity from Indonesia will curb further increase in the medium- to long-term,” analysts with Jinrui Futures wrote in a note.

With stainless steel producers stepping up maintenance in the first quarter, nickel demand could weaken from the previous quarter, according to the analyst.

About 70% of the world’s nickel production is consumed by the stainless steel sector, while batteries take up a modest 5%.

Refined nickel inventories in ShFE warehouses were last at 4,859 tonnes, close to a record low of 4,455 tonnes hit in August 2021.

S&P Global Market Intelligence forecasts global primary nickel consumption to rebound year-on-year due to stainless steel capacity expansions in China and Indonesia.

“Demand outside China is expected to be the main driver of global growth in volume terms in 2022 and global consumption is forecasted to rise at a compound annual growth rate of about 7% between 2020 and 2025,” said S&P.

“The battery sector’s nickel demand is also expected to accelerate substantially, with many predicting it to near 35% of total demand by the end of the decade.”

Short Link:

https://www.miningnews.ir/En/News/618385

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

French mining group Eramet said on Wednesday it had reached an agreement with the French government to continue its ...

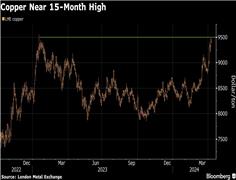

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

A US and European Union push to reach an accord on fostering critical mineral supply chains is set to miss another ...

Indonesia’s mining minister on Wednesday said divestment of Vale Canada Ltd and Sumitomo Metal Mining Co. Ltd’s shares ...

No comments have been posted yet ...