- Write by:

-

Friday, May 5, 2023 - 00:20:00

-

218 Visit

-

Print

Mining News Pro - The state of Nevada has recovered the world’s top-ranked jurisdiction spot for mining and exploration it yielded last year to Western Australia, the Fraser Institute’s 2022 annual survey of the global industry shows.

The new version of the Canadian think-tank’s popular ranking was based on answers from 180 participants, which provided sufficient data to evaluate the overall investment attractiveness of 62 jurisdictions.

The ranking is the result of a combination of two indexes — the jurisdiction’s geologic attractiveness (minerals and metals) and government policies that encourage or discourage exploration and investment, including permit times.

Canada’s Saskatchewan continues to be on the podium for overall investment attractiveness, dropping slightly from a rank of 2nd in 2021 to 3rd in 2022. Rounding out the top 10 are Newfoundland & Labrador, Colorado, Northern Territory, Arizona, Quebec, South Australia, and Botswana.

The US, Canada and Australia each have three jurisdictions in this year’s top 10, followed by Africa.

When considering both policy and mineral potential in the Investment Attractiveness Index, Zimbabwe ranks as the bottom, followed by Mozambique, South Sudan, and Angola.

Among the places the least attractive for investment, the Fraser Institute places Zambia, South Africa, China, the Democratic Republic of Congo, Papua New Guinea, and Tanzania.

In therms of regions, Africa is the region with the most jurisdictions (8) in the bottom 10, while Asia and Oceania both have one jurisdiction each in the bottom 10.

While Canada did generally well, the Fraser Institute says some provinces and territories are not capitalizing on their strong mineral potential due to a lack of a solid policy environment that would attract investment.

Ontario and Manitoba, despite being among the top ten most attractive jurisdictions for mineral potential, rank 18th and 24th respectively when considering policy factors alone. Similarly, Yukon ranks 10th for its mineral potential but 31st on cy polifactors.

Elmira Aliakbari, Director of the Fraser Institute’s Centre for Natural Resource warns that some Canadian provinces and territories are not capitalizing on their strong mineral potential due to a lack of a solid policy environment that would attract investment.

Ontario and Manitoba, despite being among the top ten most attractive jurisdictions for mineral potential, rank 18th and 24th respectively when considering policy factors alone, she said. Similarly, Yukon ranks 10th for its mineral potential but 31st on policy factors.

British Columbia continues to perform poorly on the policy front, Aliakbari said. She attributes it largely to investor concerns over disputed land claims and protected areas.

“A sound and predictable regulatory regime coupled with competitive fiscal policies help make a jurisdiction attractive in the eyes of mining investors,” Aliakbari concluded.

Short Link:

https://www.miningnews.ir/En/News/622891

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Peru’s Las Bambas copper mine, owned by China’s MMG, is facing renewed blockades of a key transport route after failed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

Lithium supplier Vulcan Energy on Wednesday announced the start of production of the first lithium chloride at its ...

Newmont confirmed on Wednesday that two members of its workforce died this week at the Cerro Negro mine located in the ...

Chinese investors are snapping up stocks tied to high-flying metals from copper to gold, aiding an onshore market facing ...

Outflows from global physically backed gold exchange traded funds (ETFs) continued for a 10th month in March, but at a ...

A stuttering recovery in lithium prices is providing a fresh reminder of why the dramatic rally of recent years was ...

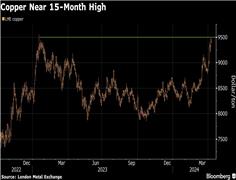

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

No comments have been posted yet ...