- Write by:

-

Monday, April 24, 2023 - 23:48:27

-

174 Visit

-

Print

Mining News Pro - The iron ore price was the lowest since November on Monday as weak steel demand in China prompted a production slowdown.

Benchmark 62% Fe fines imported into Northern China fell 4.14%, to $105.84 per tonne.

The most-traded September iron ore contract on China’s Dalian Commodity Exchange ended daytime trade 3.1% lower at 721.50 yuan ($104.69) a tonne. It earlier dropped to 715.50 yuan, its weakest since December 21.

“Despite the construction season underway (in China), steel prices have continued to fall amid weak demand and rising inventories,” ANZ commodity strategists said in a note.

More than 40% of steel furnaces in Tangshan, China’s largest steel-producing city in Hebei province, have gone into maintenance, reducing iron ore demand, they said.

“There were promising signs of better production discipline among Chinese rebar producers over the past week as mills began reacting to highly negative margins,” Atilla Widnell, managing director at Navigate Commodities, said.

Iron ore has also lost support from the supply side.

Fortescue Metals Group Ltd retained its full-year shipment guidance despite a cyclone this month that disrupted exports from Australia’s iron ore hub.

Rio Tinto has reaffirmed its annual iron ore shipments forecast after reporting a better-than-expected 15.4% jump in first-quarter shipments from Western Australia.

Vale, meanwhile, reported a 5.8% year-on-year increase in first-quarter iron ore production, while BHP Group reiterated its annual forecast for Western Australian iron ore output.

Short Link:

https://www.miningnews.ir/En/News/622850

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Iron ore futures prices drifted higher on Thursday as the latest soft data from top consumer China triggered renewed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

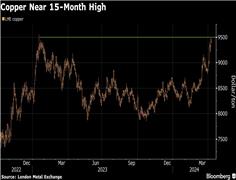

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Australia’s Fortescue said on Monday it would form a joint venture with OCP Group to supply green hydrogen, ammonia and ...

Iron ore’s reset to around $100 a ton is indicative of a broader reshaping of China’s commodities markets that favors ...

No comments have been posted yet ...