- Write by:

-

Thursday, February 2, 2023 - 12:29:42

-

178 Visit

-

Print

Mining News Pro - Analysts say American Lithium‘s Tonopah project in Nevada could run at world-beating costs based on a new study including the sale of by-product magnesium.

The operating cost of the Tonopah Lithium Claims (TLC) project, about 340 km northwest of Las Vegas, is estimated at $817 per tonne of lithium carbonate equivalent (LCE) including selling 1.7 million tonnes a year of magnesium sulphate, and at $7,443 per tonne of LCE without, according to a preliminary economic assessment (PEA) released on Wednesday.

Toronto-based Echelon Capital Markets called the magnesium “an unexpected benefit” that makes the project one of the lowest cost operations its analysts have researched globally. Tonopah also gains from very low strip ratios compared with other projects, Echelon said.

“This PEA puts American Lithium’s TLC project firmly among the leading North American-based potential producers of lithium for what is expected to be a regional supply deficit,” Echelon wrote in a note on Wednesday. “This project (is) one of the lowest operating cost projects on the global cost curve shown in our sector report.”

American Lithium’s PEA forecasts an after-tax net present value of $3.3 billion at a discount rate of 8% for an after-tax internal rate of return of 28%. The project would generate $591 million a year in after-tax cash flow and pay back investors in 3.7 years, the Vancouver-based company said.

Simon Clarke, chief executive officer of American Lithium, noted the impact of the magnesium and said the site’s 99.4% LCE purity offers the opportunity to produce battery-grade lithium carbonate or hydroxide.

“Not only are the economics very strong for high-purity lithium production, but TLC also has the potential to produce high-purity magnesium sulphates as by-products for agriculture and other end uses,” Clarke said in a news release. “Even assuming conservative pricing, these by-products can add significant economic value.”

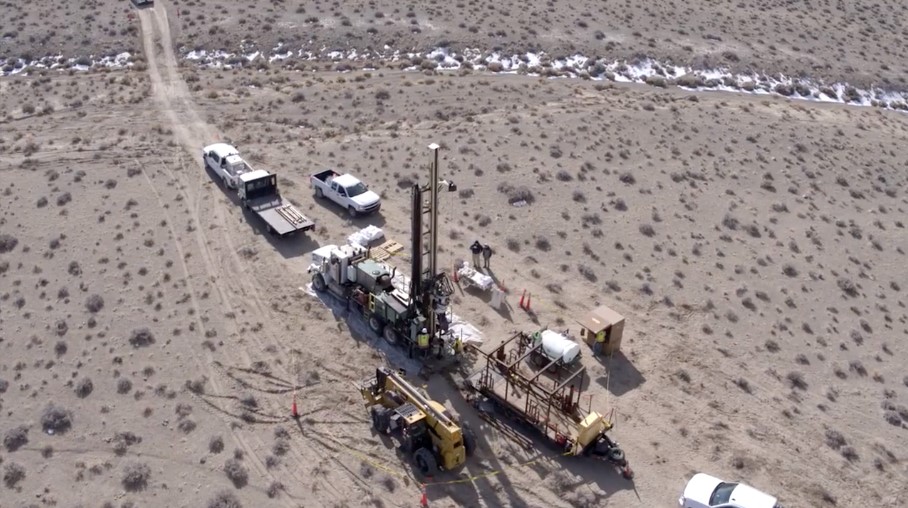

Truck and shovel

The study envisions producing 24,000 tonnes a year of LCE from truck and shovel open-pit mining before doubling to 48,000 tonnes in year seven. After 20 years the mine would process a stockpile of ore with more than 1,000 parts per million (ppm) lithium for another two decades.

The initial capital cost is pegged at $819 million (construction time of 1.2 years), total capital costs at $1.4 billion and sustaining capital at $792 million.

Analysts expect lithium to remain in high demand for years as automakers switch production lines over to electric vehicles where the light metal is used in batteries. American Lithium’s study arrives a day after GM announced plans to invest $650 million in Lithium Americas’ (TSX: LAC; NYSE: LAC) Thacker Pass project, the largest amount by a car builder in a battery metals development.

The American Lithium study uses an LCE price of $20,000 a tonne, while the spot price on Wednesday was about $72,000 per tonne. Echelon said the developer should use a higher base price because spot prices could persist above at least $40,000.

The Tonopah project could add $100 million in construction costs and $406 per tonne of LCE in operating expenses to refine LCE into battery grade lithium hydroxide, according to the study. Lithium hydroxide was selling for $73,500 a tonne on Wednesday.

The TLC claystone project in the state’s Esmeralda lithium district has a measured resource of 860 million tonnes grading at 924 ppm lithium for contained metal of 4.2 million tonnes LCE, according to an updated resource estimate issued in December. The indicated resource is 1.2 billion tonnes lithium grading 727 ppm for 4.6 million tonnes LCE.

Short Link:

https://www.miningnews.ir/En/News/622645

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

A prefeasibility study for Predictive Discovery’s (ASX: PDI) Bankan gold project in Guinea gives it a net present value ...

Chile’s state-run miner Codelco plans to select a partner for a future lithium project in one of the country’s top salt ...

A Native American group has asked all members of a US appeals court on Monday to overturn an earlier ruling that granted ...

The London Metal Exchange (LME) on Saturday banned from its system Russian metal produced on or after April 13 to comply ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

The world’s coal-fired power capacity grew 2% last year, its highest annual increase since 2016, driven by new builds in ...

Peabody Energy Corp. shares sunk to the lowest in seven months after the biggest US coal miner warned that first-quarter ...

Lithium supplier Vulcan Energy on Wednesday announced the start of production of the first lithium chloride at its ...

No comments have been posted yet ...