- Write by:

-

Wednesday, January 18, 2023 - 14:42:29

-

186 Visit

-

Print

Mining News Pro - The iron ore price rose on Wednesday as investors bet on surging demand for the steel ingredient as China’s economy reopens.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $113.60 a tonne Wednesday morning, up 3.1%.

China’s state planner on Wednesday issued its third warning this month against excessive speculation in iron ore, adding it will increase supervision of the country’s spot and futures markets.

Companies should not engage in price gouging and speculation, said the National Development and Reform Commission (NDRC), in a post on its official WeChat account.

It issued similar warnings on January 6 and 15th and summoned iron ore trading and futures companies, ordering them not to selectively quote data and information, deliberately exaggerate price increases or bid up prices.

Short Link:

https://www.miningnews.ir/En/News/622596

Iron ore futures prices ticked lower on Monday, weighed down by diminishing hopes of more stimulus in top consumer ...

AbraSilver Resource said on Monday it has received investments from both Kinross Gold and Central Puerto, Argentina’s ...

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Iron ore futures prices drifted higher on Thursday as the latest soft data from top consumer China triggered renewed ...

Vitol Group confirmed that it’s starting to rebuild a trading book for metals after a long stint out of the market, with ...

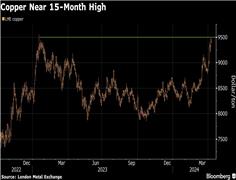

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Australia’s Fortescue said on Monday it would form a joint venture with OCP Group to supply green hydrogen, ammonia and ...

No comments have been posted yet ...