- Write by:

-

Tuesday, May 17, 2022 - 12:51:41

-

711 Visit

-

Print

Mining News Pro - Aluminium inventories in London Metal Exchange (LME) warehouses, already at their lowest in nearly 17 years, are likely to fall further over coming days and weeks as more metal leaves the LME system and heads for Europe, where supplies are scarce.

Record high power prices in Europe have pushed up costs of producing metals such as aluminium used widely in the energy, construction and packaging industries.

Western Europe accounts for about 10% of global consumption estimated around 70 million tonnes this year.

Citi analyst Max Layton said in a recent note that aluminium supply risks remain elevated, with about 1.5 million to two million tonnes of output at risk of closure across Europe and Russia over the next three to 12 months.

Shortages in Europe have resulted in large draws on LME aluminium stocks, which have fallen 72% since March last year to 532,500 tonnes, the lowest since November 2005.

Even more worrying for the aluminium market on warrant stocks — metal available to the market — at 260,075 tonnes, is the lowest on record and likely to fall further as more metal leaves LME warehouses.

“Aluminium continued its rally from last Friday after on-warrant stocks dropped to a record low, reflecting tightness in the ex-China market,” said ING analyst Wenyu Yao.

“However, supply growth has exceeded demand from China’s market…demand (in China) has been in a soft patch due to Covid-related lockdowns.”

Benchmark aluminium prices on the LME earlier hit a one-week high of $2,865 a tonne. It was last up 1.2% at $2,822.

Worries about availability on the LME has narrowed the discount for the cash over the three-month aluminium contract to $26.5 a tonne from $36 a week ago.

The physical market duty-paid premium that consumers in Europe pay for their aluminium, above the benchmark LME price, is trading at all-time highs of $615 a tonne.

Primary aluminium output in China, the world’s top producer and consumer of the metal, hit a record high of 3.36 million tonnes in April after curbs on power production eased, allowing smelters to expand operations.

Short Link:

https://www.miningnews.ir/En/News/621336

China’s state planner on Friday finalized a rule to set up a domestic coal production reserve system by 2027, aimed at ...

Chile’s SQM called another investors meeting at the request of its second-largest shareholder, Tianqi Lithium Corp., ...

Polish government is abandoning plans to separate coal-fired power plants into a special company and is considering ...

French mining group Eramet said on Wednesday it had reached an agreement with the French government to continue its ...

Vietnam’s top miner Vinacomin plans to invest 182 trillion dong ($7.3 billion) to ramp up its alumina-aluminum ...

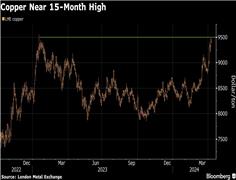

Copper traded near a 15-month high as supply concerns and brighter demand prospects triggered a slew of bullish calls on ...

Rare earths prices in top producer China jumped to their highest in more than seven weeks on Monday on a wave of ...

Copper jumped to its highest intraday price since January 2023 as the bellwether industrial metal faces rising tighter ...

A US and European Union push to reach an accord on fostering critical mineral supply chains is set to miss another ...

No comments have been posted yet ...