SQM this week sold its 50%-share in an Argentinian brine

joint venture, leaving the world’s number two producer of lithium with a

single project outside its core Chilean operations.

The $12.8 billion Santiago based company can afford to let assets go – its pipeline is choc full already.

Production startup for the 40,000 tonnes per year Mt Holland project

alongside Kidman Resources in Western Australia is 2020. The spodumene

mine will begin producing lithium carbonate and hydroxide a year later.

In May SQM announced that for a relatively modest investment of

$525m, capacity in the Atacama salt flats will be lifted from 48,000

tonnes to 180,000 tonnes within three years. Roughly $75m (less than the

proceeds of the Argentine transaction) is being spent at Salar de

Carmen this year to lift capacity to 70,000 tonnes.

That’s a headline cost of just $4,000 for each additional lithium

carbonate equivalent tonne. The ruling price for South American lithium

carbonate exports is $15,000 per tonne.

SQM’s new investor slide deck and industry outlook by Daniel Jimenez,

SVP for Iodine, Lithium and Industrial Chemicals released this week

throws down the gauntlet on its competitors and appears purposefully

designed to scare off any junior seeking to enter the lithium market.

Source: SQM August 2018

Most appeals by mining companies to investors do not start off with a

statement of just how “abundant and well spread geographically” the

chosen raw material is. SQM’s new investor presentation goes further and

repeats the tidbit in its concluding bullet points.

Nor would a company looking to attract funds make quite so much of

the assertion that its own reserves alone is “enough to supply 200 years

of the world’s 2017 lithium demand.”

And that brown and greenfield projects around the world outnumber existing mines.

Or the insignificant size of the market. SQM believes even after a

decade of torrid demand growth lithium would only amount to 6% of the

value of the copper market.

Source: SQM August 2018

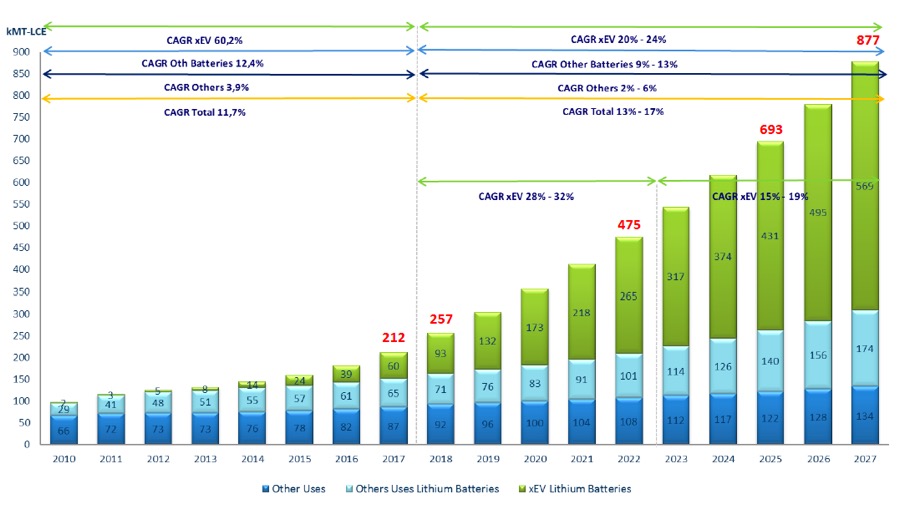

While no-one disputes that renewable energy storage, especially the

growing electric vehicle market, is driving a boom in demand for

lithium, SQM’s growth forecasts are modest.

The company foresees demand for lithium growing at a compound annual

rate of between 13% and 17% over the next decade. That puts it in the

same forecast camp as the investment bank that sparked this year’s

lithium stock sell-off.

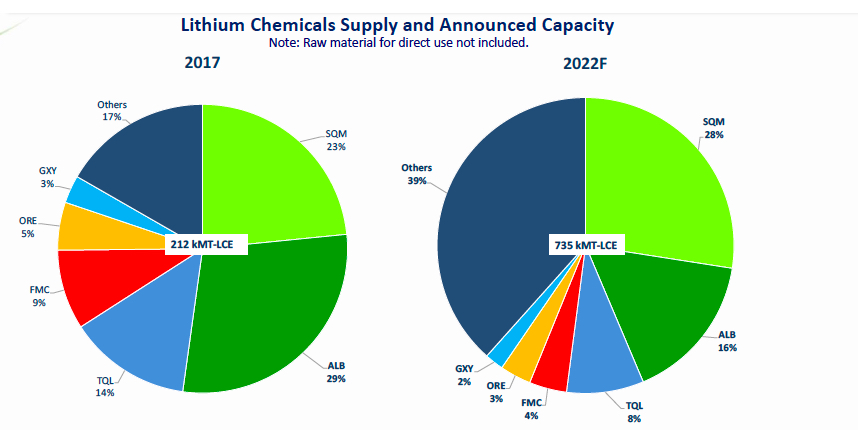

Not surprising given the aforementioned SQM is predicting an

oversupplied market, forecasting 2022 supply of 735,000t LCE, but meagre

demand of 475,000t that year.

In another sign of self-confidence SQM predicts it will “take back

the #1 global lithium producer” spot by 2022 and claim 28% of the global

market.

Cutting off current and prospective competitors at the knees is not

exactly a novel strategy (behold iron ore) in commodities markets.

And SQM has done this before. It kept its iodine prices not far above

production costs, driving out smaller players and capturing nearly a

third of the market in the process. Like lithium its iodine reserves in

the Atacama is vast and cheaply exploitable.